Crypto & News603 Views

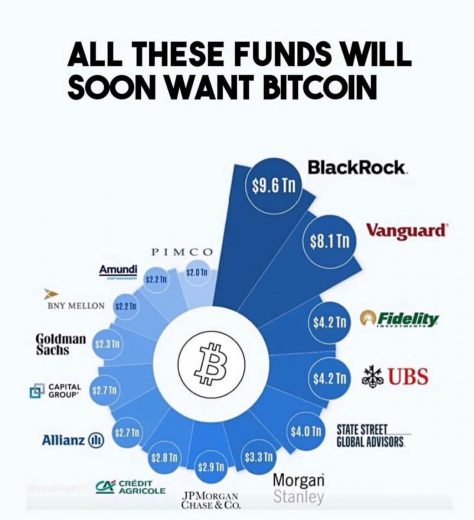

All these $50 Trillion of AUMs & top Banks funds will soon want Bitcoin in 2025

Best US crypto exchanges, Coinbase, Kraken & Binance to join SEC & USA to make new ideas about Banking transaction with top Assets Under managements. upto $50 Trillion of AUMs & top Banks funds will invest in Bitcoin. Banking & Financial transaction, BlackRock and top AUMs accepted Bitcoin whitepaper to make Peer-to-Peer payments. top 20 Banks in the race of Bitcoin ETFs, digital assets, Digital Bonds, Digital USD, and Gold Investing. Institutions Crypto or Bitcoin traders, investors, and developer at the banking system.

World’s top banks, startups, AUMs (Assets under management), Asset Management banks, and countries are looking to invest in Bitcoin or decentralized technology to increase the future of the world. All these funds want Bitcoin, Ethereum, and the lightning network. In the near future year 2024, Bitcoin might handle almost $5 trillion USD in their market cap with the price of each Bitcoin at $75K to $100K in the charts and CEX prices. All the funds of these banks or AUMs are looking to integrate with new infrastructure, technology expenses, developments, Securities, institutions opportunities for creativity, and lightning-fast instant transaction technology of a decentralized wide-range ecosystem.

Top Asset management company BlackRock ($9.7 Trillion USD Market Cap) is looking to invest or spend billions on the security of top traders, investors, and developer teams to make the easiest ways of having Bitcoins up to 1 Million. At least 25% of BlackRock funds owners are looking to spend their money on Bitcoin to make early before it reaches $ 1 million USD at each Bitcoin price.

Top Assets Management & Banks wants Bitcoin to make new ideas to become the world’s top banks on earth. Top banks to adopt Bitcoin 80% of their large share of Bonds, USD, and Gold quota.

- Vanguard ($8.1 Trillion),

- Fidelity ($4.2 Trillion),

- UBS ($4.2 trillion),

- State Street Global Advisor ($4.0 Trillion),

- Morgan Stanley ($3.3 Trillion),

- JP Morgan Chase ($2.9 Trillion),

- Credit Agricole ($2.8 Trillion),

- Allianz ($2.7 Trillion),

- Capital Group ($2.7 Trillion),

- Goldman Sachs ($2.3 Trillion),

- BNY Mellon ($2.2 Trillion),

- Amundi ($2.2 Trillion),

- Pimco ($2.1 Trillion)

These are has a large capital growth than state banks or top reserve banks of any country.

There are a lot of new opportunities are coming for the future of digital assets and limited supply with decentralized technology.

top banks look like accepting Bitcoin and investing on the Bitcoin mechanism and soft market cap banks are going to accept small cryptos and stablecoins to increase digitalization.

In the near future 2025, Banks and AUMs are looking to migrate or start spending huge money on it. There are a lot of Institutions are demand of the best digital currencies to secure investments, safety, and market cap, instead of gold, instead of stocks to make sure any decision with Bitcoin and altcoins. All these (Above listed) are has a demand of ETFs with SEC to manage all the funds under the Decentralized technology than USA rules or global rules of any countries & USD.

Top these banks are already confirmed they just don’t want to hurt the USD & Gold but they want digital securities for those people who creating, developing, or investing in the new businesses ideas of blockchain technology. Bitcoin is the final option for all the banks, technology, and creativity to move forward in the world without the permission of any companies or government.

As the SEC (Securities Exchange Commission ) & USA banks have thoughts about Bitcoin and blockchain interests due to high volatile market of cryptos. All World Banks are going to stabilize the Crypto industry and Bitcoin prices to make the world adoption rate in the banks and digital financial system.

Coinbase, Robinhood, Kraken, and Binance are has the green signal in the world to serve during the huge acceptance of Cryptography investments or businesses of the future. Binance will face more critical moments if US investors or SEC require a high security or tax-related funds authority. Coinbase is rapidly growing in the international or American market with a large amount US and top richest countries who trusts Coinbase in Asia, Africa, European & North America. Finally, $50 trillion USD market cap is looking to be added to Bitcoin, Ethereum, and USDT & the top stable of the most profitable coin for long-term investment.

BRICS countries to reduce $3 trillion USD forex reserve from US Dollar and EURO, BRICS vs US war

Trump plans to lift sanctions on Russia to import Russian oil by aiding the Ukraine war

North Korea to purchase the Bavar-373 air defence system against US presence in East Asia

Trump Fears Iran could transfer its nuclear weapons to Venezuela to counter the US in Middle East

Iran plans to acquire 40 Chinese J-10 fighter jets and HQ-19 system to counter Israeli and US Air Force

Apple is hiring Cheap Asian labor to boost manufacturing in US, Trump Tariffs 2026

How Iran shoots down Israeli F-35 fighter jets using its Domestic air defense system?

Israeli Iron Dome, MIM-104 Patriot and Arrow 3 failed to intercept Yemeni Burkan-2H missiles

NATO plans to steal Ukrainian Mineral Worth $18 Trillion in Exchange of debt to Zelensky

Russia to deploy S-400 systems to Yemen, North Korea and Iran against Israeli and US conspiracy

BRICS countries to reduce $3 trillion USD forex reserve from US Dollar and EURO, BRICS vs US war

Trump plans to lift sanctions on Russia to import Russian oil by aiding the Ukraine war

Dragon Pass, BlackRock and Qatar acquire Adani group amid India Pakistan tension

Why are Japan, South Korea, Vietnam, and India to impose Tariffs against Chinese Imports?

China earns $500 billion in Profit amid Trade War with US, China’s economy skyrocketed

EU imposed $40 Billion worth of tariffs in retaliation Against US Imports, Coup in EU?

China and EU preparing against Trump Tarrifs, US sanction, US Dollar and economic crash

US Treasury gains $25 trillion in Trump’s Tariff war by year of 2030, Is US Russia Cold War End?

India could join OPEC after discovered crude oil deposits in North East India