Crypto & News998 Views

Bitcoin Will flips Saudi Aramco, Apple and Microsoft in March 2024 : Bitcoin News

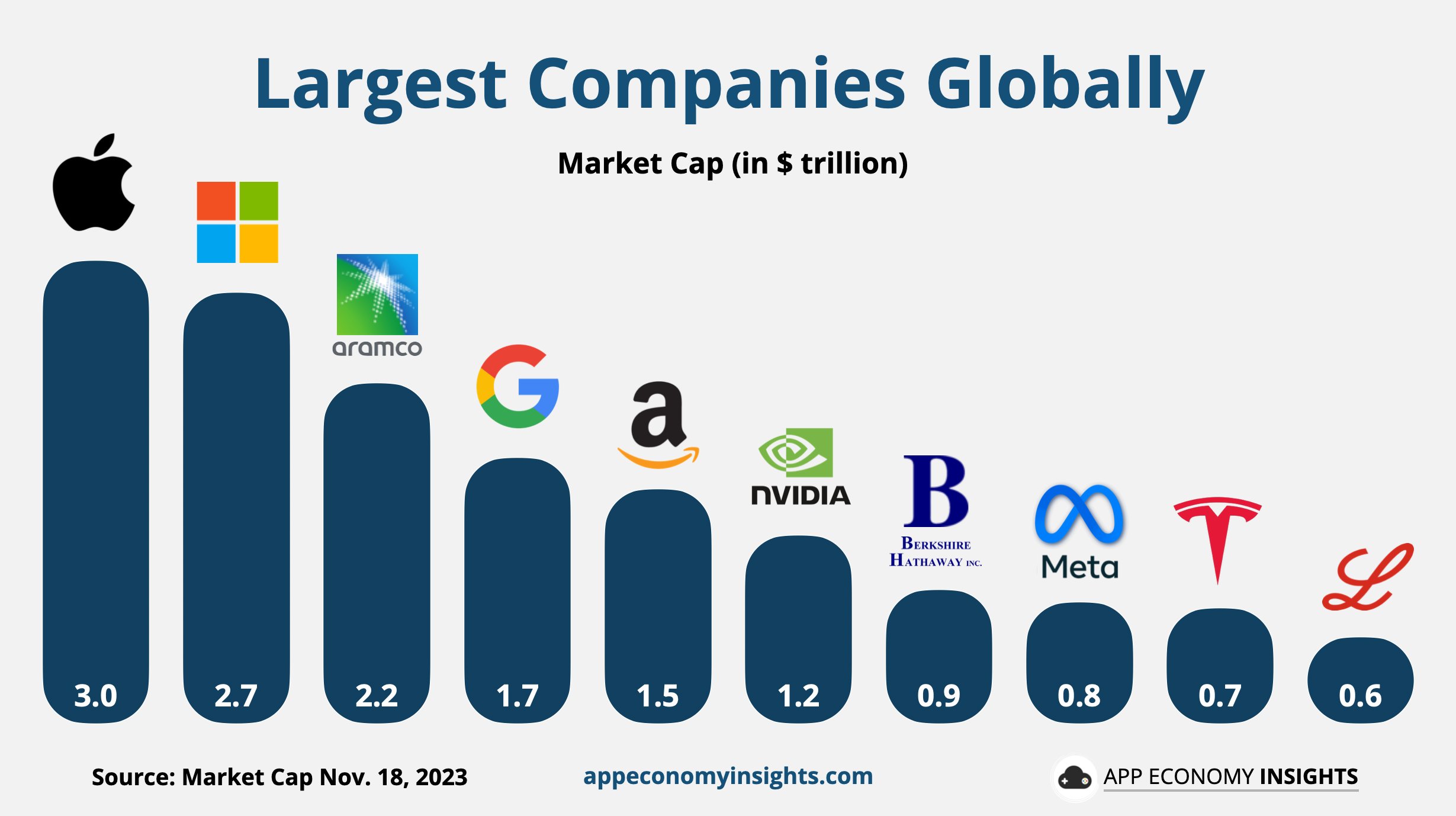

Saudi Aramco, Apple and Microsoft investing in Bitcoin, Renewable Energy, Qatar, UAE, and Saudi Arabia adopt Bitcoin, El-Salvador, SEC, US Congress, BlackRock, Startups, and Qatar are trying to buy Bitcoin and Trade with Bitcoin. Bitcoin News for Middle East, US and Europe. Middle East to purchase Bitcoin, Nvidia, gold and Renewable energy stocks in 2024.

Currently, due to Bitcoin ETFs and Bitcoin halving news, experts of big companies have also believed that Bitcoin can flip companies like Saudi Aramco, Apple, and Microsoft in 2024. Because currently the wealth and international funds of El-Salvador, SEC, US Congress, BlackRock, Startups, and Qatar are trying to reserve Bitcoin and hence this is the worst news for Apple, Aramco, and Microsoft. Currently, approximately $300B has been added to the market cap of Bitcoin in the last 4 months, which is much of a shock for large companies, banks, and assets managers. Apple, Saudi Aramco, and Microsoft have also believed that the price of Bitcoin can go up to $100K in the year 2024 and hence they are also now short on Nvidia (AI), Blockchain-based stocks, and renewable energy. Also, people in the US, Europe, and Indo-Pacific are investing in Bitcoin but others in Saudi, UAE, Qatar, Kuwait, and Oman are mostly investing in crypto, blockchain, startups, and renewable energy, which means that Bitcoin is a long-term investment. In Arab can be done in large Bitcoins quantities in the Middle East. The Crypto and Bitcoin ETFs application may be approved by SEC and MiCA to offer Bitcoin trading, FUTURES, and Bitcoin bonds in 2024.

Recently, Apple, Microsoft, and Saudi Aramco have so much money that it is more than the economy of many countries. In such a situation, those companies want their global dominance should continue and their name among the top companies should also remain for a long time, but now the ever-increasing dominance of Bitcoin is not only a threat to the companies but is a challenge for the entire internet world. Recently it has been reported that there is about $250 billion in interest per month on the Bitcoin domain which is continuously coming into Bitcoin.

Why are Energy Stock, Bitcoin-based Stocks, Crypto, AI, and Blockchain companies value surge in 2024?

Currently, Qatar, UAE, and Saudi Arabia are moving towards Bitcoin which means that the Middle East is investing in a new energy whose value will be more than gold, silver, and companies and that is Bitcoin. Recently I have been told that Saudi Arabia is a country where the growth of Crypto transactions is increasing because most of the Apple users in the world are in Saudi Arabia. Most of them hold Apple phones in the US but if we talk about the total population in the rest of the world, 75% of the population of Saudi Arabia uses Apple smartphones. Due to all this in Saudi, they purchase Apple stocks, Microsoft stocks, and Bitcoin through Apple phones. The good thing is that any other country in the Middle East can hold Crypto, Bitcoin, and NFTs as per their wish and there is no tax on holding and buying.

Iran become world’s first nation to detect Cancer, Kidney and cardiovascular disease using Nuclear medicine

US demands return of $20 Billion for US Aid from Taiwan, as Shutdown ongoing, and US military paychecks dues

BlackRock eying $14 trillion Venezuela natural resources, US-Maduro War, $26 trillion Ukraine mineral

Khamenei lifts ban on IRGC’s 12,000+ range of Upcoming surprise missiles during US sanctions

10 nations has continued buying Iranian oil despite massive UN, US, and Western Sanctions

Newmont expects $1 trillion of Gold to enter the US market amid rising Stock liquidity & Shutdown crisis

Pakistan tested its Fatah-4 cruise Missile range of 750km to deploy in Saudi Arabia and Middle east

Netflix loses $5 billion in a day after Elon Musk told his followers to boycott Netflix, and LGBTQ, over Charlie Kirk

Russia’s imports of Iranian Drones, Missiles and Aerial Weapons amid rising tension in Ukraine

China may possibly transfer nuclear capable Hypersonic missiles to Iran to shoot down B 52 bomber & Nuke Tel Aviv

Iran become world’s first nation to detect Cancer, Kidney and cardiovascular disease using Nuclear medicine

BlackRock eying $14 trillion Venezuela natural resources, US-Maduro War, $26 trillion Ukraine mineral

10 nations has continued buying Iranian oil despite massive UN, US, and Western Sanctions

Newmont expects $1 trillion of Gold to enter the US market amid rising Stock liquidity & Shutdown crisis

BlackRock buying Billions worth of GOLD with Newmont to boost its Gold reserve, US stock crash

Trump plans to resume buying Russian Oil, Eggs and Natural Gas amid the Ukraine War

NVIDIA Stock could reach $265 amid rising demand for AI, Data Center, Gaming, and renewable energy mining – Morgan Stanley says

Trump to unfreeze Russia’s $800 billion assets across NATO to extend Ukraine Ceasefire talks in Moscow

BRICS countries to reduce $3 trillion USD forex reserve from US Dollar and EURO, BRICS vs US war